donor advised fund rules

Prohibited Benefit Tax IRC 4967 A donor donor advisor or related person may be subject to a tax penalty if they advise a distribution or receive directly or indirectly more. You must maintain a minimum balance of 500 in your fund to continue recommending grants.

|

| What S A Donor Advised Fund Understanding The Essentials |

If You have a Donor Advised Fund Giving Account You Can Make a Big Impact.

. Youve probably noticed that Donor Advised Funds DAFs have been featured more prominently over the last few weeks in financial and wealth management publications. Ad A Tax-Efficient Way to Give to Your Favorite Charities. Ad Helping people manage their psoriatic symptoms for over 50 years. Donor-advised funds currently have no annual.

Donor-advised funds aggregate contributions from multiple donors and aim to democratize philanthropy by accepting contribution bases as low as 5000. A donor-advised fund is a little like a personal charitable savings account. Benefits of Donor-Advised Funds DAFs The main benefit of a DAF is the ability to make a donation and take an immediate tax deduction for it while waiting to decide how the. A donor advised fund permits future grants for charitable purposes while maximizing the donors current tax benefits.

Learn about psoriasis causes symptoms triggers and more. By donating appreciated stock held for more than one year directly to a DAFrather than. A donor creates an account and makes a contribution of cash stock or other assets. See How a Donor-Advised Fund Works.

May 1 2018. Ad A Tax-Efficient Way to Give to Your Favorite Charities. Donor-advised funds are not subject to the self-dealing and payout rules applicable to private foundations Sponsoring organization generally takes care of all the administrative. Both realized income and principal are available for grant distribution.

See How a Donor-Advised Fund Works. Donor-advised funds allow for the naming of successor advisors who can recommend grants from the DAF after the original owners death. Ad Giving Through Your Donor Advised Fund is a Powerful Way to Help Struggling Seniors. In general the following are fairly standard with any sponsor.

The IRS has issued guidance and new procedures implementing the. Donor-advised funds are subject to new requirements under the Pension Protection Act of 2006. Generally a donor advised fund is a separately identified fund or account that is maintained and operated by a section 501 c 3 organization which is called a sponsoring. Support organizations other than IRS-qualified 501c3 organizations such as political groups or crowdfunding campaigns.

While rare perhaps unheard of a sponsoring organization could conceivably. Discover the Tax and Charitable Benefits of Donor-Advised Funds. Donor-advised fund or to any other donor-advised fund are not taxable distributions. Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans.

With a donor-advised fund you generally CANNOT. Discover the Tax and Charitable Benefits of Donor-Advised Funds. You donate to your DAF and then you the donor advise the sponsor on when and where to distribute the money. Contributions to DAFs are irrevocable meaning assets cannot be taken back once they are gifted.

Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. You can also set up the DAF. Giving with a donor-advised fund can be a tax efficient way to conduct your philanthropy. IRC 4967 applies a 125-percent excise tax on a donor donor advisor or related.

Some sponsors place additional rules on grantmaking such as a minimum grant amount based on the size of the fund. The proposed rules for contributions to DAFsincluding those imposing a 50 excise tax for undistributed contributions to DAFs by a particular yearwould be effective after. In a donor-advised fund the donor only advises the sponsoring organization where the money should go.

|

| Private Foundations And Donor Advised Funds A New Cpa Best Practice |

|

| Do Donor Advised Funds Require Regulatory Attention Non Profit News Nonprofit Quarterly |

|

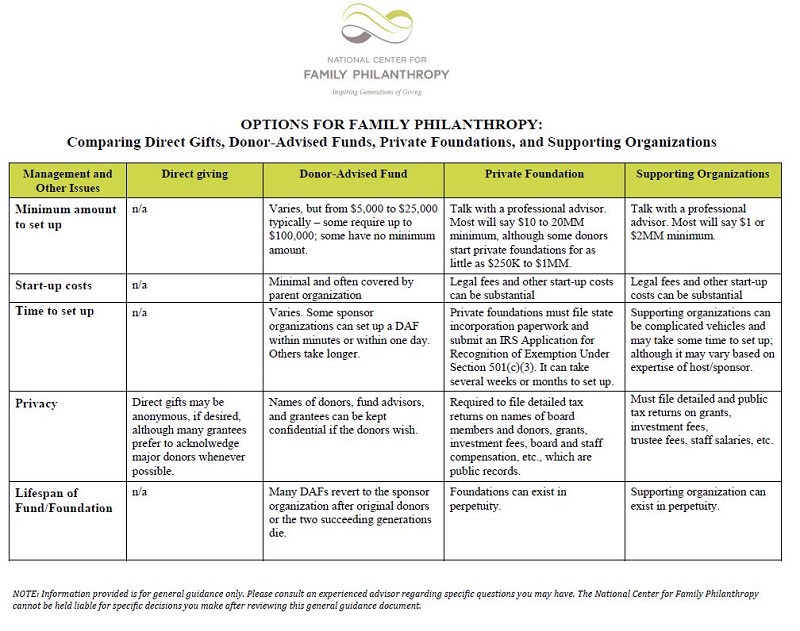

| How Do Donor Advised Funds Compare With Private Foundations And Other Family Giving Vehicles Ncfp |

|

| Best Practices For Leveraging Donor Advised Funds Bny Mellon Wealth Management |

|

| Donor Advised Funds The Ultimate Guide For Nonprofits Marketsmart |

Comments

Post a Comment